The Importance of Tenant Checks: A Guide for Tenants and Landlords

Finding the right tenant is one of the most important steps in ensuring a smooth tenancy. A thorough tenant check not only protects landlords from potential financial and legal issues but also helps tenants present themselves as reliable and responsible renters. Below, we provide a detailed, step-by-step guide for both tenants and landlords on what these questions mean, why they matter, and how to conduct thorough checks.

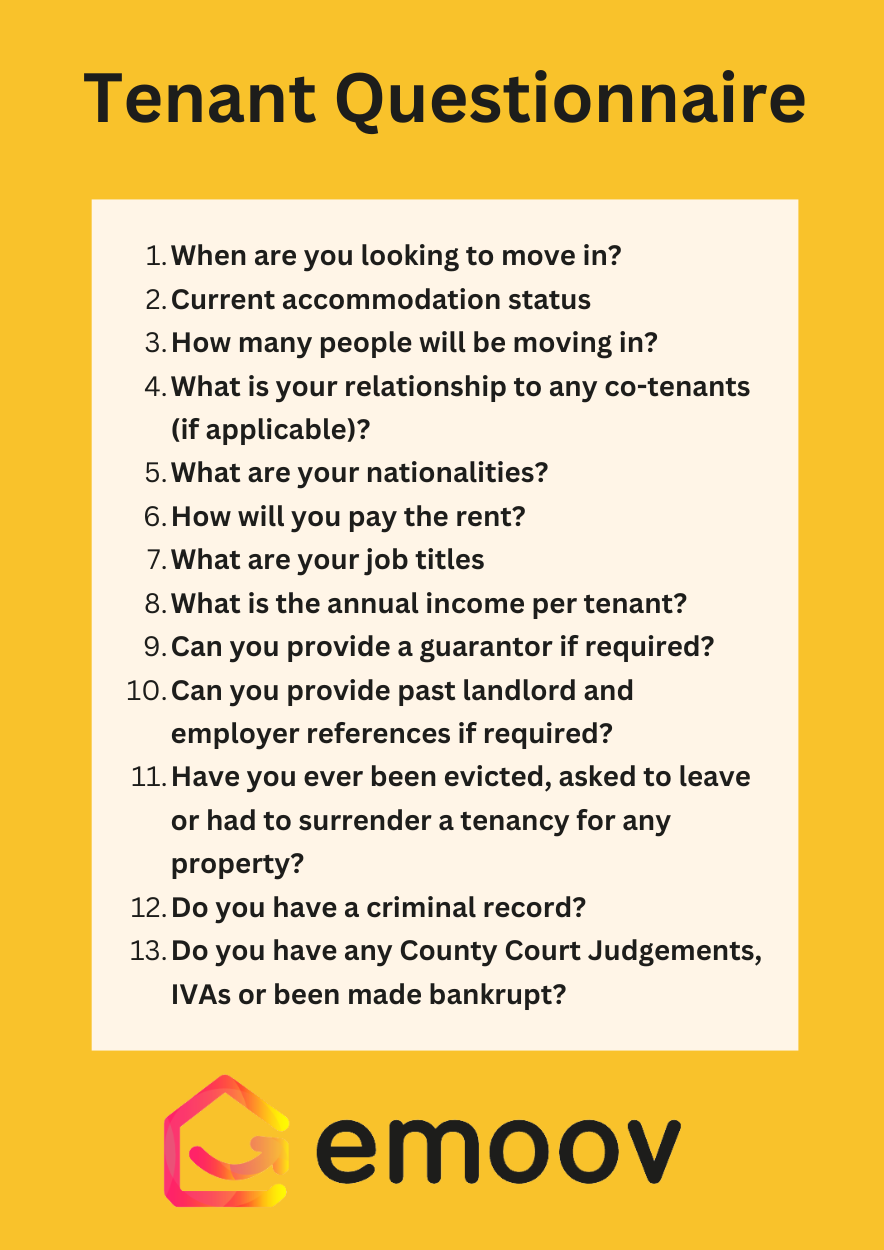

For Tenants: Completing Your Application Form

Filling out a rental application is your opportunity to demonstrate that you are a trustworthy and responsible tenant. Here's how to ensure your application stands out:

1. When are you looking to move in?

Be realistic about your move-in date. If it's too soon, the landlord may not have time to prepare the property. If it's too far in the future, they may opt for a tenant who can move in sooner to avoid a rental void.

2. Current accommodation status

If you are currently renting, providing a landlord reference can be a strong indicator of reliability. Ensure you are registered on the Electoral Roll as landlords may check this to confirm your identity and address history.

3 & 4. Number of people moving in and relationship to co-tenants

Licensing rules may apply depending on household size. If multiple unrelated people are renting together, the landlord may require a House in Multiple Occupation (HMO) licence. If you are renting as a group, state your relationships clearly to avoid licensing complications.

5. Nationality and Right to Rent

Landlords are legally required to carry out Right to Rent checks to ensure tenants have the legal right to live in the UK. You can prove your status via https://www.gov.uk/prove-right-to-rent

6. How will you pay the rent?

Landlords will want to ensure you can afford the rent. Generally, your household income should be at least 2.5 times the annual rent. Remember

that tenants are jointly and severally liable so this means you are both responsible for the rent payment, so if one person earns less or cannot pay, the other will have to.

If you are self-employed or on irregular income, consider providing six months of bank statements as proof of earnings.

7 & 8. Job title(s) and annual income

Stable employment is a key factor for landlords. If you are new to a job, offering additional proof such as an employment contract can help. If references from employers take time, recent payslips or tax returns may help verify your financial stability.

9. Can you provide a guarantor if required?

If your income doesn't meet affordability criteria, a UK-based guarantor may be required. Some tenants opt for professional guarantor services, which are worth exploring if you don't have a suitable individual.

10. Can you provide past landlord and employer references?

Landlord references help verify that you've been a responsible tenant. If references are difficult to obtain (e.g. during holidays), providing six months of rent statements can be a good alternative.

Employer references confirm income stability. Large companies often process references through HR departments, which can take time.

11, 12 & 13. Evictions, criminal record, County Court Judgements (CCJs)

If you have a past eviction, CCJ, Individual Voluntary Arrangement (IVA), Bankruptcy or criminal record, honesty is key. Landlords may check your credit history via Experian, Equifax, or TransUnion.

If required, you can provide a DBS check: Apply here: https://www.gov.uk/request-copy-criminal-record

For Landlords: Reviewing Tenant Applications

Tenant screening protects your investment and ensures long-term stability. Here's what to consider:

Move-in dates

Plan for tenancy transitions, ensuring there's time for thorough cleaning or property repairs, safety checks, and inventory check-out & make/check-in.

Accommodation history

Request written references or rental payment records from previous landlords.

Use the Electoral Roll to verify the tenant's address history.

Household size and relationships

HMO Licensing: If the property is being rented by three or more unrelated tenants, it may require a House in Multiple Occupation (HMO) licence. For larger HMOs (five or more unrelated tenants), a licence is mandatory in England and Wales.

Council Regulations: Even smaller properties may require a licence if the local council has additional selective or additional licensing schemes in place. Landlords should always check with their local authority.

Compliance: Failure to obtain an HMO licence when required can result in substantial fines (up to £30,000 or unlimited civil penalties), rent repayment orders, and potential legal action. Check HMO licensing rules: https://www.gov.uk/find-licences/house-in-multiple-occupation-licence

Right to Rent

It is a legal requirement for landlords to check that tenants have the Right to Rent in the UK before agreeing to a tenancy.

Landlords must check original documents (e.g. passport, visa, biometric residence permit) or use the Home Office online service.

Keeping copies of these documents for at least 12 months after the tenancy ends is required to comply with government regulations.

More information on Right to Rent checks can be found here: https://www.gov.uk/prove-right-to-rent

Financial stability

Ensure the tenant meets the 2.5x rent affordability threshold.

If self-employed, request bank statements, tax returns, or an accountant's letter as proof of income.

Consider running a credit check via services like Experian or Equifax to identify any financial red flags such as CCJs, IVAs, or a history of late payments.

If affordability is a concern, a UK-based guarantor should be required, ensuring they also undergo financial checks.

Renting to a Company

If you are considering renting to a company, it's important to understand that this creates a non-Housing Act tenancy, meaning different legal protections apply.

Always check the company details via Companies House to verify that it is UK-based and legitimate:

https://www.gov.uk/government/organisations/companies-house.

Typically, two signatories are required to sign the tenancy agreement; either two directors or a director and company secretary.

Renting to an overseas company can present legal difficulties, as UK landlord protections may not apply.

Upcoming Changes with the Renters' Rights Bill

The Renters' Rights Bill will introduce significant changes, making it even more critical for landlords to conduct proper checks. Key changes include:

- Abolition of Section 21 evictions, meaning landlords will need valid grounds to regain possession.

- Restrictions on rent in advance, limiting landlords to requesting a maximum of one month's rent upfront.

- Stronger tenant protections, making affordability and tenant history more important than ever.

For more on the Renters' Rights Bill, check out our full guide.

By conducting thorough checks and staying informed, both tenants and landlords can ensure a smooth, hassle-free rental experience.

Excerpt:

Tenant checks are a crucial step in securing a smooth and hassle-free tenancy. Whether you're a landlord looking to protect your investment or a tenant wanting to present yourself as a reliable renter, understanding the screening process is key. From verifying affordability and Right to Rent checks to licensing requirements and renting to a company, this guide walks you through everything you need to know.

Tags:

TenantChecks, LandlordTips, RentingGuide, PropertyInvestment, RightToRent, HMO, Guarantors, TenantScreening, LettingAdvice, PropertyLaws, LandlordandTenantLaws, TenantReferencing

Image is from an unfurnished and newly decorated two bedroom mid terrace house with good sized garden and parking for 2 cars. Available to rent February 2025. For the full listing see here

.png)

5 Costly Mistakes Landlords Are Making in 2026 - And How to Avoid Them

23.02.2026The rental market is evolving fast. From compliance to pricing and ownership structure, here are five costly mistakes landlords are still making - and how to avoid them.

Why Tenant Referencing Matters More Than Ever When Letting a Property

19.02.2026A practical landlord guide to tenant referencing, Section 21 changes, court delays, and why rent guarantee insurance adds peace of mind.

.png)

Sell or Let Your Property Yourself – Why More UK Homeowners Are Choosing to Go Online

03.02.2026Selling or letting a property no longer has to mean handing over thousands of pounds to a traditional estate agent.

Why 2026 Could Be the Smartest Year Yet to Grow Your Rental Portfolio

15.01.2026Thinking of growing your rental portfolio this year? You're not alone. New data shows that rental yields are climbing across the UK, with smart landlords expanding through limited companies, targeting high-performing regions, and refinancing to reinvest.

Why Stay in the PRS? A DIY Landlord’s Guide to Riding the Market Wisely

30.10.2025If you're a landlord feeling under pressure from new legislation, rising costs, or uncertainty around mortgage rates, then you're not alone. But before you hang up your keys, take a breath. The Private Rented Sector (PRS) is still a viable-and profitable-place to be. Here’s why some landlords are choosing to stay, what the data says about yields and mortgage pressures, and how DIY landlords can make it work.

The Renters’ Rights Act: What Landlords Need to Know Now

30.10.2025The Renters’ Rights Bill is now law; and landlords need to be ready. From the end of Section 21 evictions to tougher property standards and new compliance rules, the changes are significant. If you're a landlord or thinking about selling a tenanted property, this is your heads-up to get ahead of the curve. Read our updated guide to learn what’s coming and what you can do now.